Urban Amenities and the Impact to (Re)development

A growing body of research indicates that people pay more to have access to urban amenities. For example, houses close to parks are generally more valuable. Parks, schools, small retail, and transit are some of the amenities that make for a rich urban experience. When considering development and redevelopment potential it is important to also consider how investments, but public and private, can change the desirability of an area. A package of urban amenities can increase desirability and competition for real estate in an area. This in turn increases the rent that property owners can achieve. Higher achievable rents can allow developers to consider larger scale, higher quality real estate projects. The increased investment activity can result in a "virtuous cycle" of even more desireability and investment.

What are the Impacts of Specific Amenities?

Isolating the specific impact of individual amenities can be quite complicated. Often times urban amenities are not present by themselves, but rather areas have several different amenities. Sidewalks, street trees, parks and transit can all be present in urban neighborhoods. Isolating which of these has the most impact can be challenging. Evidence suggests that, when it comes to urban amenities, a well functioning package of amenities may have more impact that the individual sum of it's parts. There is a synergy that occurs in highly amenitized areas that is difficult to achieve with only a few amenities.

Latest Amenity Research

Researchers at the University of Utah have conducted Hedonic Pricing Studies in both Austin and Salt Lake City to determine the impact of various urban amenities on home prices and commercial property values. The research is a presented below for download. While several of the outcome are intuitive, analyzing the impact of urban amenities within single cities can lead to some preculiar results also. Unique factors in a given city can perturb results. Additional research on a larger sample size is needed to help get a clearer picture of the impact of each amenity.

How to Use Amenity Reseach with Envision Tomorrow

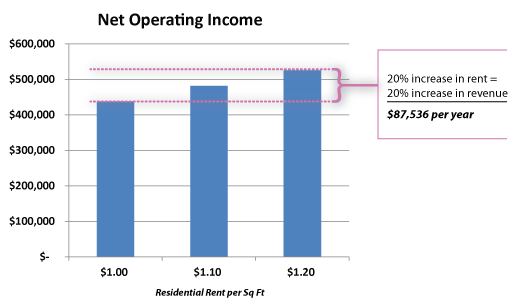

The research on urban amenities indicates that a rich urban experience can increase achievable rents in an area. From a developer's perspective, the achievable rent is the key to deciding what types of projects are feasible. Similarly, when using Envision Tomorrow for scenario modeling, users must create a variety of building prototypes and each of them includes assumptions about achievable rents. Depending on the rent levels, certain buildings will "pencil" and certain others may not. Understanding what types of development projects are feasible within the short to medium term is an important learning process for planners, decision makers and stakeholders.

One of the first steps in a scenario planning exercise is to understand the current market. Once basic market research is complete, the amenity research can allow planners to understand how high rents could be above current levels if public and private investments were to occur in the area. For instance, a planner identifies that current residential rents are $1 per square foot in a study area today. The city is contemplating zoning changes to allow more intensity as well as investments in a variety of amenities, such as street trees, transit and open space. The planner can safely assume that, with the zoning changes and new urban amenities, the residential rents could increase anywhere from 10-20%. That amount of increase means that the range of rents the planner can include in their ET building prototypes is $1.10-$1.20 per square foot. Even such a seemingly small increase can make certain project types profitable that wouldn't otherwise be. Consider this: if a 3 story apartment building has 40,000 square feet of leasable area, an increase in rent from $1 to $1.2 per square foot is an additional $87,500 per year in net revenue, or 20% more revenue.