Regional Fiscal Impact Tool (ReFIT)

What does it do?

The purpose of the fiscal impact model is to consider the short and long-term changes in revenue and spending associated with of municipal services, environmental protection, economic development, transportation, and infrastructure. A very real challenge is that many projects and services are paid for on the local level, and in any given scenario, some communities may see more success than others. For this reason, the fi scal impact analysis must ultimately tell a regional story that underscores the collective gains of multi-jurisdictional cooperation: it is about growing the pie, not figuring out who gets which slice.

This app is used to estimate the net fiscal impact to local governments of different development scenarios. It shows where there are opportunities to expand the tax base without needing to expand existing services. Scenarios can be evaluated based on how much positive future revenue they produce that can be invested in the community and used to leverage private investments.

How does it work?

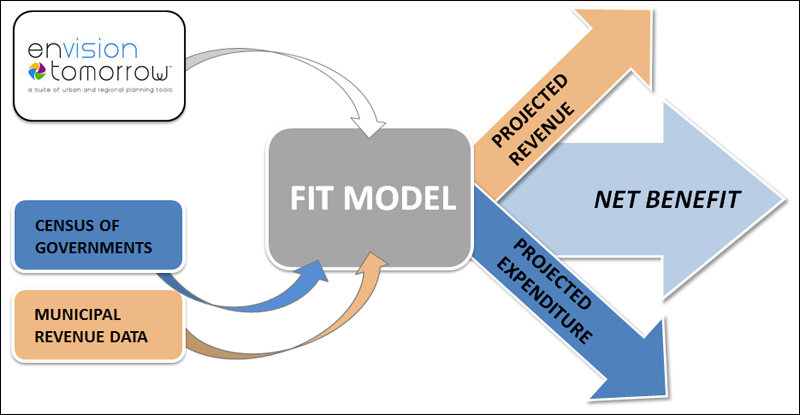

The app is a stand-alone spreadsheet that integrates with the scenario spreadsheet outputs. The latest version of its fiscal impact tool is modeled after the Federal Reserve Board’s “Fiscal Impact Tool”. It includes FIPS-driven fiscal lookup tables for the entire U.S. It circumvents irregularities of local budget reporting and makes fiscal analysis efficient and standardized. The inputs include local tax rates and municipal population as well as scenario outputs relating to population, employment, and property value of new construction. The app uses this to calculateboth projected future revenue and increases to per capita operations and maintenance costs. The ratio of total revenues and total costs allows users to compare current conditions and multiple future development scenarios.